Engineering Economy - Section 1 (2)

- Home

- Civil Engineering

- Civil Engineering Questions and Answers

- Engineering Economy - Section 1

Engineering Economy - Section 1

This is the branch of engineering in which we study about

economy. There are problems available to solve in this section. You can give test and solve these

MCQs.

| 9. | The key to profitable operation for project cost control, is : |

|||||||

Answer: Option C Explanation: No answer description available for this question. Let us discuss. |

| 10. | Each financial ratio is generally compared by |

|||||||

Answer: Option D Explanation: No answer description available for this question. Let us discuss. |

| 11. | In a cash-flow diagram : |

|||||||||

Answer: Option E Explanation: No answer description available for this question. Let us discuss. |

| 12. | If S is the future capital accumulated in n years at the rate of interest i per annum, then present worth is : |

|||||||

Answer: Option A Explanation: No answer description available for this question. Let us discuss. |

| 13. | The interest calculated on the basis of 365 days a year, is known as : |

|||||||

Answer: Option C Explanation: No answer description available for this question. Let us discuss. |

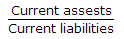

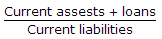

| 14. | Current ratio is : |

|||||||

Answer: Option A Explanation: No answer description available for this question. Let us discuss. |

| 15. | The capital Recovery Factor (equal payments) of Capital Recovery Annuity is : |

|||||||

Answer: Option A Explanation: No answer description available for this question. Let us discuss. |

| 16. | Pick up the correct statement from the following: |

|||||||

Answer: Option D Explanation: No answer description available for this question. Let us discuss. |